Earlier this year, I went to Amazon (through the website, not the mobile app) and was looking for soap. I don’t recall clearly, but I must have been looking for Hamam soap given that it was quite cold last winter in Bengaluru (it’s over now and the heat is on!) and our skin was getting really dry. The general belief and understanding (unfounded) in our family is that Hamam soap dries the skin a bit less, though I haven’t found any evidence of this – we just assume it to be true 🙂

So, I went to Amazon and wanted to place an order for a Hamam pack of 4. And an ad for Clean Sense soap was right on top of the page!

I have not heard of this soap at all, but a couple of things got my attention in the listing: the soap’s description said ‘Ayurvedic’ and added that the soap has ‘massage spikes’. The photo used showed the massage spikes and it was so intriguing for a soap – I thought I was seeing a tablet strip and had to click it if only to see how the soap actually looks! The price was also attractive at Rs.50 per piece in a pack of 3.

Most interestingly, the brand itself had positioned it not as a bath soap but as a hand-wash soap (despite them having a liquid hand-wash product too)!

It was only after buying the soap that I noticed that the hand-wash use case was framed only to take advantage during peak COVID season when our senses were extra alert on hand-wash.

It seemed good, and I placed an order along with Hamam.

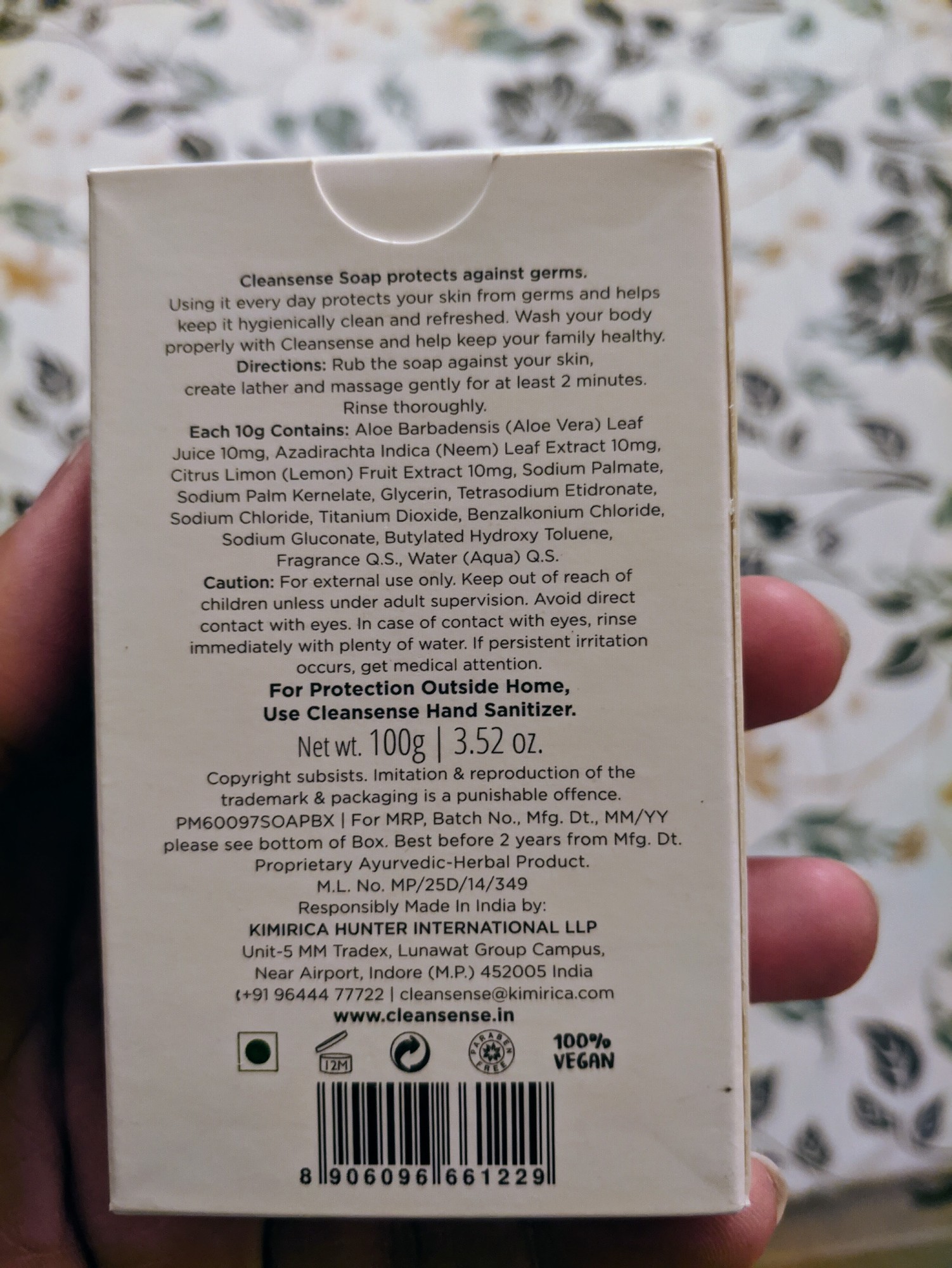

The Clean Sense soap turned out to be absolutely incredible. The lemony fragrance was mighty impressive – possibly the most pleasant and memorable fragrance in a soap that I was trying for the first time. The soap lists quite a few chemicals that I wonder if the claim of being an ‘Ayurvedic’ soap is entirely true. Plus, our skin continued to get dry (like any other soap), so the actual point I ordered it for wasn’t met. But I can foresee this to be a fantastic soap in summer – the fragrance and freshness would be totally great for a summer evening bath (already here in Bengaluru!).

The interesting point is this: the ONLY way I got to know about this soap was through the special position that placed it (through advertising inside Amazon) right on top of the page, and any other product listing, while I was searching for Hamam soap.

While I’d assume that this soap, as a blind buy, being liked by me was a coincidence/fluke, this advertising got me thinking in a couple of directions.

1. What is the real-world/offline equivalent of this?

Would it be Clean Sense taking up an island-type point of purchase display in a departmental store just inside the aisle that stocks soaps?

Or, is it simply paying a premium to the store owner and get the soaps stacked up at the beginning of the soap aisle (from either side)?

Technically, I think it’d be the latter, though I don’t know if such options do exist in the offline space – the former option does exist, I’m aware of that.

The point is, even if the soap is placed first in the soap aisle, the impact won’t be as it appears in the digital store. The eye movement in the digital store is from top to bottom, generally. So Amazon, though its advertising option, made sure that I would not miss the advertising at all. That is extremely efficient advertising, according to me (even if I don’t end up buying it, I may at least register the brand).

2. Context of advertising

Even though I love advertising in general, I don’t recall clicking on any online ad in a very, very long time 🙂 Even the ones that intrude my timeline on Instagram, Facebook, or Twitter; definitely not Google ads.

But when I’m on Amazon, even if I’m just browsing/researching, the context is at least window shopping, if not actual shopping intent. Inside that intent, if I see even a half-relevant ad that shows options that fit my search query, then that is the kind of relevance that brands dream about (or spend a lot of time and effort trying to recreate offline). That a relatively unknown brand like Clean Sense could pull it off is a great leveler for brands regardless of their size.

3. In-house brands vs. non-Amazon brands

Of course, I’m fully aware that Amazon is notorious for placing their in-house products in any and every search, that too, not as paid spots, but organically in the search results. A lot of media space has been expended on this and there are several, persistent allegations about how Amazon adds new products to their in-house roster using data from what’s selling well.

This has helped me too, in quite a few instances. For example, while we were looking for roasted whole chana with skin, Amazon’s own Vedaka brand came on top (not as an ad) and was cheaper than any other option available! Ditto for lounge pants – I was looking for some during last winter, and Amazon’s own Symbol brand came on top, again, not as an ad. The quality of both Vedaka and Symbol products was good – no complaints at all.

4. A digital democracy?

For small brands to pull this off in the offline world, that too in front of a national audience, would seem impossible. There’s a reason why distribution is seen as a tangible winning strategy in offline retail and only large brands that can flaunt their offline armies of salespeople could afford to win in the offline world.

But, for an unknown brand like Clean Sense to get pan-India attention (even for a small period of time; depending on the cost of keeping the ad on top for soap-related searches) seems like a pretty good deal, even if they try it like a trial run.

To be able to pull it off regardless of their offline sales might, and using only advertising budget (that too, without spending anything on creating desire in terms of creativity/imagination), it seems like an efficient way to be in front of the most appropriate audience.

5. D2C vs. Amazon

After I bought Clean Sense from Amazon, I wanted to know more about the company and searched for them. I landed on and noticed that they were selling the same pack of 3 for Rs.140, Rs.10 lesser than Amazon!

And, as usual, they had a Shopify-enabled online store – almost every D2C brand seems to be Shopify-enabled these days. It’s almost like the online retail war is between Amazon and Shopify, though both cater to very different kinds of online sales (the former is an online store while the latter is an enabler for brand stores).

But, despite the savings (Rs.10), I found myself considering only Amazon for a repeat order. Amazon, with its seamlessly fast delivery (particularly on Prime) is more a habit than a shop. I order a lot from direct brand stores too (for example, Kaalesuwari oil or Cinthol), but for most purchases, if they are available on Amazon, that would be my first preference. It’s just so completely hassle-free that small amounts of difference/benefits in pricing won’t sway the choice of place to order.

Given that there are so many small, niche D2C brands with a lot of interesting products, more than advertising for awareness/visibility (creating a desire to buy), trying the Amazon advertising route to gauge audience interest seems like a great way to start, before tweaking the marketing mix further.

PS: Considering I wrote a post on online influencers and disclosure just yesterday, let me add that this is NOT a paid post. I have no connection whatsoever with the makers of Clean Sense… except as a paying customer. I just happen to be someone who likes soaps 🙂. Also, none of my posts about any brand/product/service are influenced by anything other than my own curiosity, interest, and observation.