I was at an offline store yesterday (I hardly ever go out these days – this was absolutely necessary. Please head out only if it is necessary).

After picking up what I needed in a basket, I got them billed. I wrote a cheque for the amount and handed it over to the billing counter. The billing person took it and passed it to another employee who took the cheque and headed out to the bank to encash the cheque. I was asked to wait till they were able to deposit the cheque so that I can pick up my items and leave the store.

Sounds ridiculous? It’s 99% true except for the payment mode I chose. I chose Google Pay.

There was a QR code right at the billing counter (by PhonePe). As I have done numerous times, I chose to use Google Pay instead of handing over my debit card.

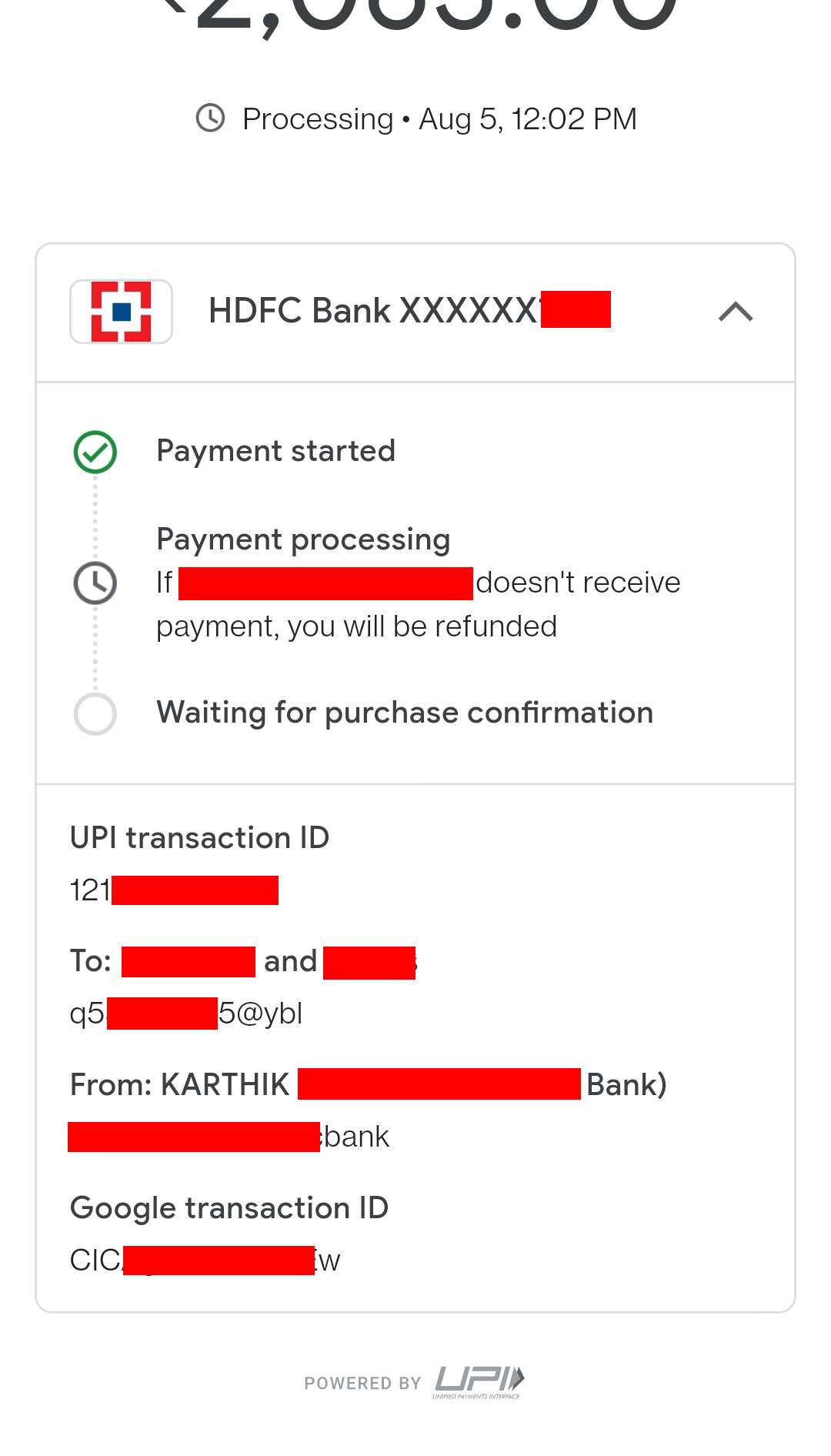

After I confirmed the payment in Google Pay, it tried to pass the transaction but I did not get the familiar confirmation sound in a few seconds like I always do, predictably. It was stuck in a limbo of ‘payment processing’. I had no idea how to deal with this and checked whatever options that were on the screen.

Did I do something wrong? Entered my PIN incorrectly?

No, I didn’t – in any case, if the PIN was wrong the transaction would have failed, not stuck in limbo.

Did I not have enough funds in my account?

Not at all. There was enough to make this payment.

Was the internet connectivity poor inside the store?

Hardly. Full signal, 4G.

This reminded me of the early days of online payment where I used to literally pray as I click a ‘pay’ button! It’s just that I have never gone through those stages of uncertainty with mobile app-based payments even when they were new!

The screen said, ‘Payment started’ – ‘Payment processing’ and ‘Waiting for purchase confirmation’. The top-right menu had ‘Get help’ and ‘Send feedback’.

‘Get help’ asked me to raise a ticket in case the payment is stuck. I did. Back to limbo.

‘Send feedback’ asked me to send an email to Google Pay. I wasn’t sure sending an email was of any point while I’m at the billing counter trying to pay and move on. So I did not.

And, that’s it. No option to cancel the under-process payment so that I can simply pay the store using my credit/debit card, or pay them cash (I had all 3 + mobile payment options!) and move on.

But, there was no cancel option.

I told the billing person. He was as flummoxed as I was. He asked me to wait for a few minutes. I waited for 15 minutes. The screen was on ‘Payment processing’.

Finally, totally exasperated, I told the billing person that I will pay by card, and if, and when, the payment from Google Pay is also transferred, I will come and seek a refund in cash. They said that was perfectly fine and because the shop was very close to my home, and even if I’m not a regular visitor to the store, this worked well.

I have used Google Pay many, many times in the past couple of years. On rare occasions, the payment has been mildly delayed (a few more seconds) possibly because of poor internet. But it has never been stuck on ‘Payment processing’… ever. This was the first time. Till this happened, I had taken Google Pay for granted, as much as I trust a debit card or cash.

But this experience was harrowing. It shook my trust in smartphone-based payments despite this happening for the first time (to me). Why? Because of how helpless it made me feel at the store.

I couldn’t do anything but just expect it to sort out by itself. I cannot pick up my items. I could not cancel the payment under process so that I can opt for an alternate mode of payment. I could not leave the store without those items – what if the payment went through later? Plus, I needed what I had purchased.

Imagine if this was a store farther from my home (or in another city)… or one that I do not visit often.

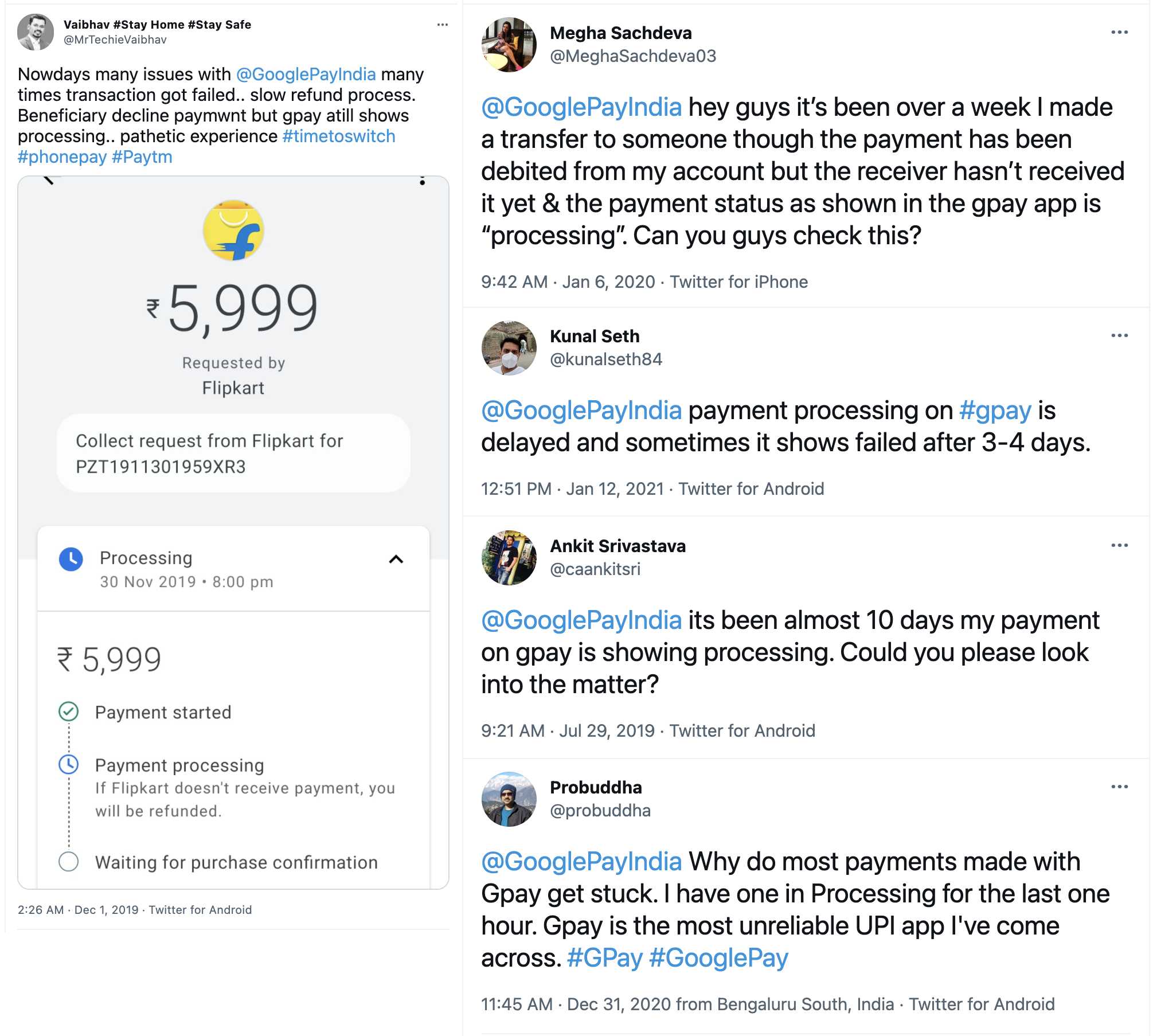

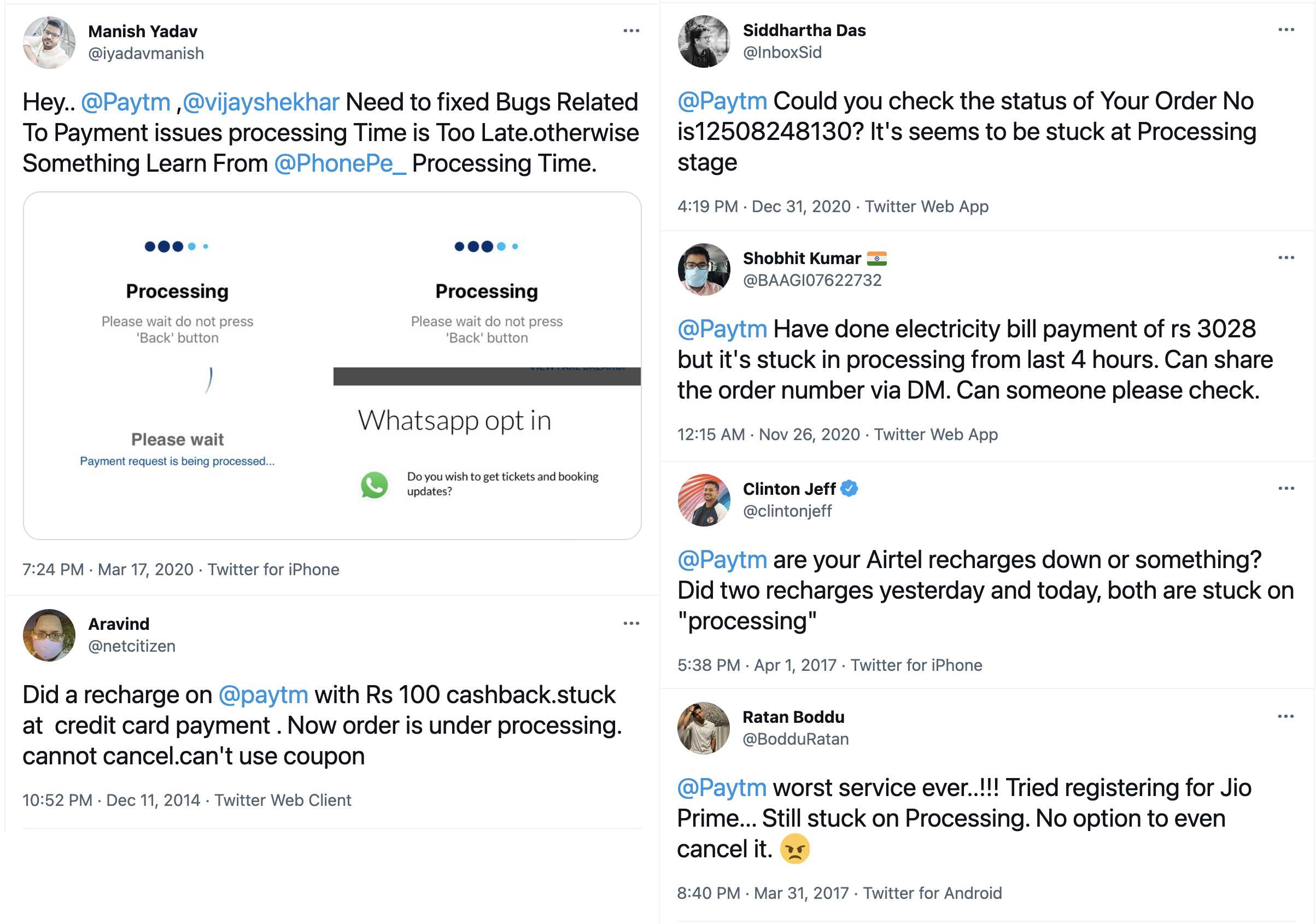

I came home and Googled this payment limbo. Turns out that I’m very lucky to not have faced this all this while – there is so much chatter and questions about this online, and across all smartphone-based payment apps – Google Pay, PhonePe, Paytm!

And to think Paytm is even making fun of other payment apps over ‘stuck payments’! One look at the replies that skewer Paytm and you know that they are not in the best position to make fun of others.

I did send that email via ‘Send feedback’ option where I shared the transaction ID and asked Google Pay to cancel that pending processing of that payment.

It cannot be like this. If the payment is stuck for whatever reason, there has to be a way to mitigate that situation so that a user is not stuck too along with the processing status of the payment. I do understand that refunds could take time, but at least if there is an option to initiate cancellation of the process, a user could get some form of closure on the next step.

But the solution is not to ask the user to either tweet to the brand (many people opt for this, if they have the luxury of time, and they are paying from home and not at a store) or speak to or chat with the customer representative (this could be apt if you at your home and have time, but when you cannot afford to spend time on the follow-up after expecting a payment to just go through normally).

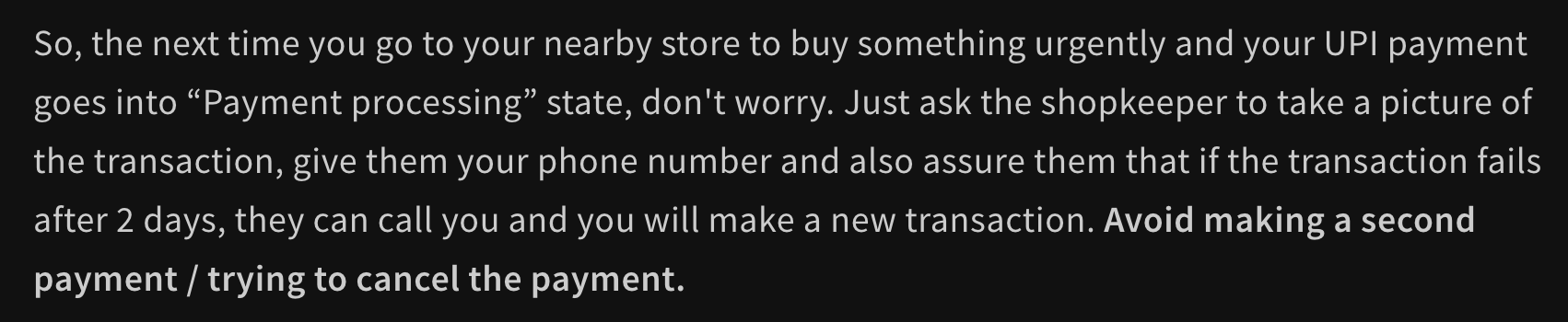

Later, when I searched online for potential solutions to what I could have done, I found one kind of solution in a post by Fampay!

In hindsight, I realize that there are only 2 ways to deal with a situation like this when you are at a store outside your home (as against making a payment from your home): ask the other person to trust you and wait till the limbo resolves itself, or you trust the other person to hold on till the limbo resolves itself.

Fampay’s method was to ask the shopkeeper to trust you.

What I ended up doing was that I trusted the store instead and told them I would come back if the payment goes through, for a cash refund.

I’m sure there’s a perfectly logical explanation (explained quite well in the Fampay post linked above) to what happens to ‘payment processing’ limbo that involves UPI, banking back-end software, inter-bank transaction protocol, mobile payment apps, and RBI (among others). But understanding that logic won’t help formulate the next step while I’m in a billing queue trying to pay and get on with life.

If anything, all those entities—UPI, payment apps, and RBI—should have assumed that this is a possibility and included a step a user could invoke within the app, proactively, that does not involve wasting more time in discussing the issue.

To be sure, Google Pay’s ‘Help’ page has a video about ‘stuck payments’. And I did play that at the store while waiting helplessly for 15+ minutes (what else is there to do anyway?). But all it says is, “Trust us. It will go through. If it doesn’t, it will go through eventually. Don’t retry the transaction.”. Not very helpful, is it?

There are tons of videos from many people who are trying to be helpful in a ‘payment processing’ limbo situation. But none of them offer anything remotely close to a path that can help someone in a billing queue. That means this is an open problem that the payment apps have not thought through and expect people to do whatever they can/want on their own and fight the battle later.

Imagine if the amount was much larger.

Imagine if the need was very pressing and the user has no other source of money to pay.

Imagine if the user was in a hurry.

Imagine if the other person is in dire need of money (and not just a store).

Imagine if this was the last date to make some payment.

Imagine if the payment option for the service you are trying to pay refuses to entertain another mode of payment because its own system says your payment is already processing! (I saw quite a few comments like this online where people were trying to pay for an IPO)

I can think of so many situations that could be far worse than the one I was in. I believe I was reasonably lucky that my amount was small (enough) and I could find a way to solve the issue temporarily and move on.

But, I don’t think I’m going to be able to trust mobile app-based payments for quite some time. I fully understand that technology can go wrong and things can go awry at times and that an exception shouldn’t become a rule.

So, I’d perhaps consider additional parameters before choosing mobile app-based payment. Like,

Is the place close to home so that I can go back to seek a refund if needed?

Is the amount small enough that I wouldn’t mind being stuck in a payment limbo while I pay through another mode?

Is there no other payment mode available that I’m left ONLY with mobile app-based payment?

Is it the last day to make a payment, or if I do not pay (or the payment is stuck), will I lose access to something vital?

If the answer is a ‘yes’ for all 4 criteria, then I’d not opt for mobile-based payment. Debit or credit cards work perfectly fine in any case, besides cash (if I had it with me).

Given that my bank was involved in the back-end, I was reasonably sure that losing the money will never be an issue. I could eventually raise a dispute, showcase double payment, as it happens with card swipes, at times, and get the money back anyway. This was more about being stuck because the payment processing system got stuck for no mistake of mine. And feeling totally helpless without any way to resolve something while being stuck at a point of purchase.

PS 1: Either because of my email via ‘Send feedback’ where I had asked Google Pay to cancel pending payments, or because of some other reason, when I checked Google Pay later last night, it informed me that the payment had failed. Meaning: I don’t need to go back to the store!

PS 2: I’m sure someone is bound to think, ‘Don’t cards—debit or credit—fail while one is trying to pay with them?’. Sure, that is a possibility, though I don’t think I have ever faced that even once in my possibly-2-decades of using them. But I believe there is an option to reverse a card payment. Plus, more importantly, as an account holder or a card holder, I have a direct relationship with the bank so I know what to do and whom to ask, if there is an issue. With an intermediary like Google Pay, PhonePe or Paytm, I do not have any direct relationship with them – they are an intermediary between me and my own money in the bank that carries it.

PS 3: Title reference to Trishanku: